- #Hedge funds meaning registration

- #Hedge funds meaning plus

- #Hedge funds meaning professional

You should know where your money is going, who is managing it, how it is being invested, and how you can get it back. You are entrusting your money to someone else.

If you don’t find the investment adviser firm in the SEC’s IAPD database, call your state securities regulator or search FINRA's BrokerCheck database.You can search for and view a firm’s Form ADV using the SEC’s Investment Adviser Public Disclosure (IAPD) website.

#Hedge funds meaning registration

You can get this information by reviewing the adviser’s Form ADV, which is the investment adviser's registration form.Make sure hedge fund managers are qualified to manage your money, and find out whether they have a disciplinary history within the securities industry. Hedge funds typically limit opportunities to redeem, or cash in, your shares, to four times a year or less, and often impose a "lock-up" period of one year or more, during which you cannot cash in your shares. Understand any limitations on your right to redeem your shares.A performance fee could motivate a hedge fund manager to take greater risks in the hope of generating a larger return.

#Hedge funds meaning plus

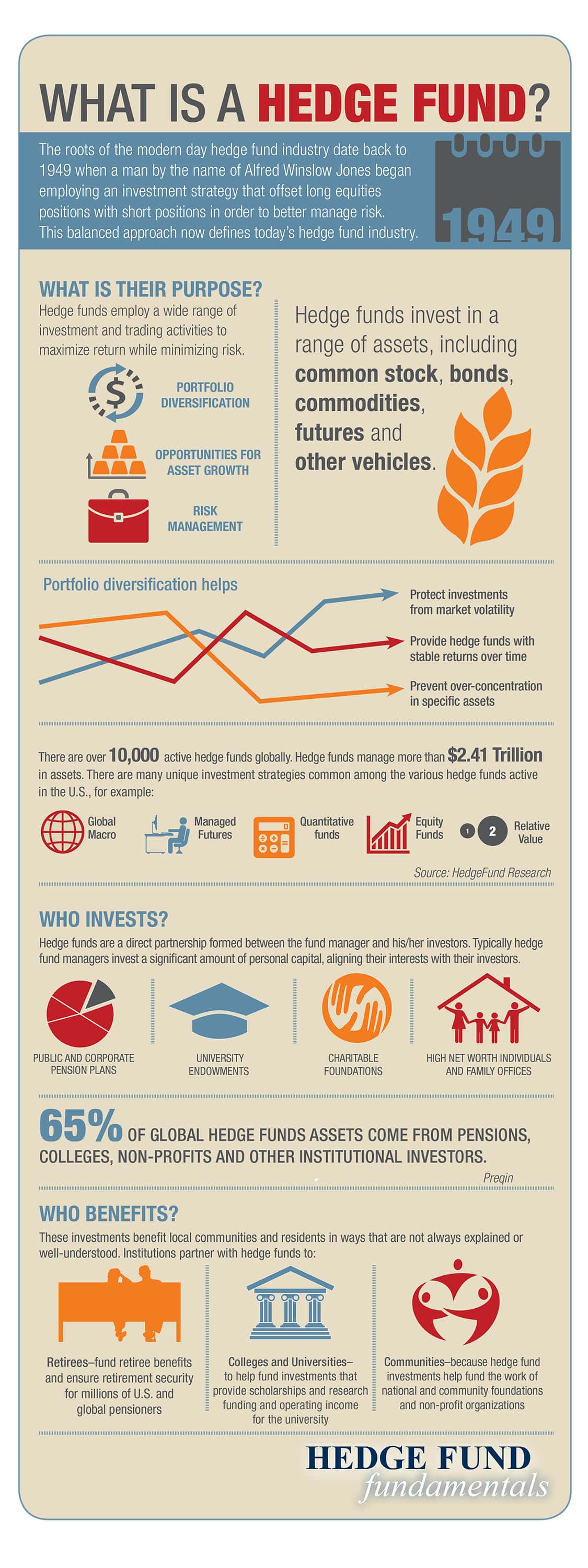

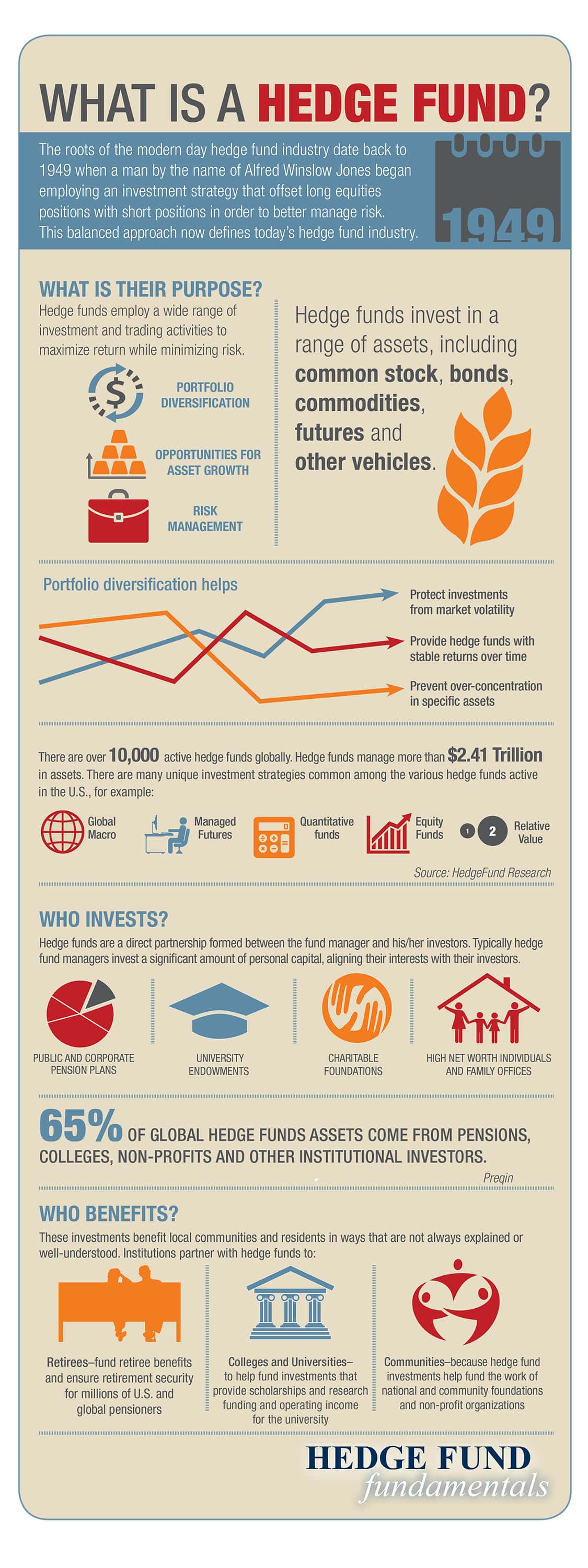

Hedge funds typically charge an asset management fee of 1-2% of assets, plus a “performance fee” of 20% of the hedge fund’s profit. You should understand the valuation process and know the extent to which a fund's holdings are valued by independent sources.

Hedge funds may hold investments that are difficult to sell and may be difficult to value.

Understand how fund assets are valued. As with any investment, the higher the potential returns, the higher the risks you must assume. Make sure you understand the level of risk involved in the fund's investment strategies, and that the risks are suitable to your personal investing goals, time horizons, and risk tolerance. Read a fund's prospectus and related materials. You generally must be an accredited investor, which means having a minimum level of income or assets, to invest in hedge funds. What should I know if I am considering investing in a hedge fund? Hedge funds are limited to wealthier investors who can afford the higher fees and risks of hedge fund investing, and institutional investors, including pension funds. Hedge funds are not regulated as heavily as mutual funds and generally have more leeway than mutual funds to pursue investments and strategies that may increase the risk of investment losses. Hedge funds pool money from investors and invest in securities or other types of investments with the goal of getting positive returns. The Laws That Govern the Securities Industry. Researching the Federal Securities Laws Through the SEC Website. Structured Notes with Principal Protection. Smart Beta, Quant Funds and other Non- Traditional Index Funds. Mutual Funds and Exchange-Traded Funds (ETFs). Publicly Traded Business Development Companies (BDCs). Stock Purchases and Sales: Long and Short. Pay Off Credit Cards or Other High Interest Debt. Public Service Campaign (new) – “Investomania”. Required Minimum Distribution Calculator. #Hedge funds meaning professional

Investment Professional Background Check. Working with an Investment Professional. Five Questions to Ask Before You Invest.

0 kommentar(er)

0 kommentar(er)